Founded in 1997 by Jeff Nixon, Interactive Capital Partners (ICP) has financed and helped build over 30 new companies based on disruptive technologies and business models in Internet, Nanotechnology, Cyber Defense and Environmental Sustainability. ICP contributed to building these companies with a strategic network of senior executives and successful entrepreneurs, supported by investment from leading venture capital firms, and strategic angels, family office and corporate investors. We always took a significant amount of our financing compensation in the form of equity for long-term alignment with shareholders and management. Accordingly, we frequently invested substantial time and energy in building management teams, recruiting world-class Board members, making key client introductions and building strategic channel partnerships needed to build shareholder value.

Over the past several years, Interactive Capital has been building a new platform called Steward Global Capital as a growing collaborative of experienced disruptive tech investors, family offices and social Impact funds committed to originating and driving investments with “Impact at Scale”. We have extensive experience in investing and building companies in the technology and Sustainability sectors and now wish to leverage our experience with others who share our values and goals.

Stewardship.

The careful and responsible management of

something entrusted to one’s care.

Impact at Scale. Over the past decade, Social Responsibility and Sustainability have gone from “nice to have” to “need to have” for consumers, business partners and government policy setters/ regulators. This is opening markets to disruptors with major innovations at an unprecedented rate. Potential major shifts in market share are driving a rapidly accelerating race between innovators and legacy companies trying to protect their franchises. As investors, investing in companies with the technology enabling this race creates an opportunity for outsized financial and social returns at the same time for those businesses able to scale. This is our focus.

THE COLLABORATORS

JEFF NIXON

Co-Chairman/ Managing Partner

Jeff built his career on backing passionate teams with disruptive technologies and business models driving large scale positive change in the Internet, Nanotechnology, Cyber Defense and Sustainable Technology industries. <more>

ERIK JANSEN

Co-Chairman/Managing Partner

JEFFREY FELDMAN, PhD

Position

<more>

JILL WATZ

JOE DOBROW

He is also the founder of MBArk (www.MBArk.net), which helps to connect business education and the food business through career networking programs for MBA students and executive education programs for industry leaders. <more>

TOM BURTON

DOUG MELLINGER

<more>

TOM BEUSSE

FIRST PRINCIPLES

UNIQUE STRATEGY

Build the Force Multiplier in Sustainability

SECTOR FOCUS

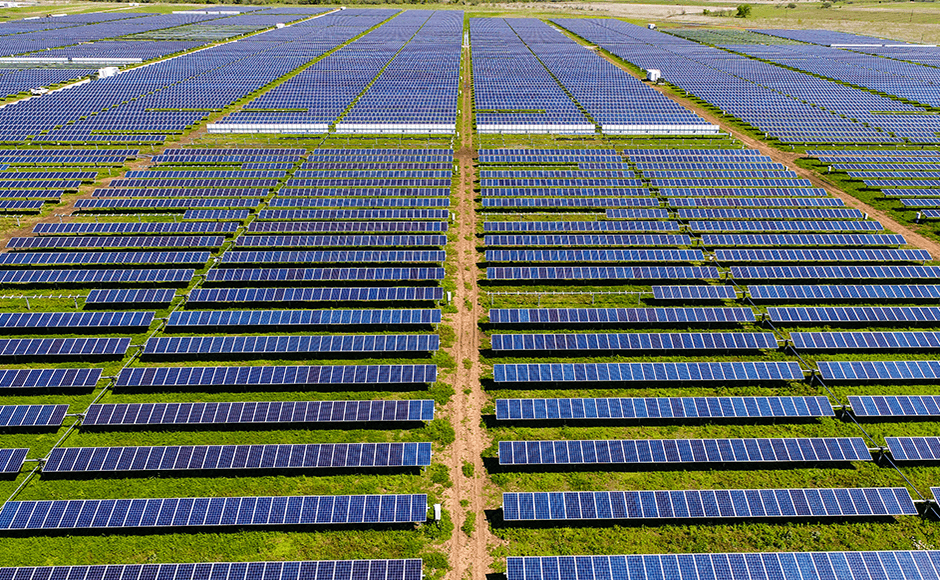

ENERGY

- Solar panels and systems

- Wind turbines and systems

- Batteries/Capacitors

- Thermal systems and materials

- Electro/Mechanical motor and pump efficiency

- Monitoring & Control for conservation

WATER

- Monitoring

- Purification, Treatment

- Conservation

- Irrigation

- Reclamation

FOOD

- Natural/Organic Foods

- Crop Yield Improvement

- Organic pesticides

- Waste use/reduction

- Data and Sensing

- Supply Chain

ENVIRONMENT

- Waste and Recycling

- Emissions Control

- Conservation

- Measurement & Control

HEALTH

- Pharmaceuticals

- Medical devices

- Medical Services

- Heathcare IT

INVESTMENT STRATEGY

Impact at Scale

- Must address large/serious problems

- Real change

– Not incremental - Rapidly adoption

– No excess market friction - Global potential

Concrete Goals

- Clear measurements

- Trackable

- Accountable

Growth Stage Focus

- 90/10 growth equity/venture

- Growth Stage:

– $5-50 million revenue.

– $10-30 million investments - Venture:

– $0-5 million revenue

– Ability to hit Growth Stage in 2-3 years

– $2-10 million investments